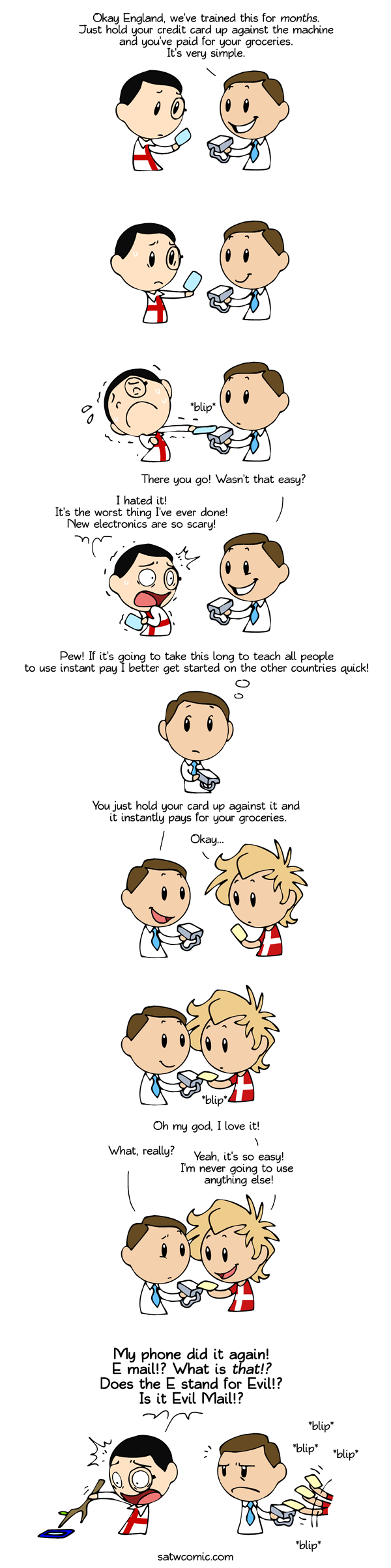

New World

If you only visit England on vacations you won't notice, but if you decide to move there like I did, you will start to realize how scared England as a nation is of new technology.

Like, several of the people working at the bank where I got an account didn't know how to send an email and had never done it in their life. I repeat, people working at a BANK.

So it was no surprise to me that it took months and months to get English people to use instant pay while in Denmark it happened practically over night.

(It feels a lot like tooting Denmark's horn here, so I would have liked to add more countries, but I have no idea how quick they were to use instant pay and it's impossible to find info on online).

Denmark England

17th February 2017

9 years ago #9598456

9

0

I worked in a grocery store in Finland once and I had a not-so-sober man try to pay for his stuff with a library card ffs

9 years ago #9597746

8

0

Call my a cynic, but I don't think a system that allows money to be extracted from your bank account without even a token bit of security is a good idea.

9 years ago #9599454

6

0

On the other hand... shortly after moving from the UK to Silicon Valley I went to my first US sf con, where I went along to the panel on cutting edge technology where they were burbling about the new and exciting developments in mobile phone tech that would be coming Soon! and wasn't it great to be piloting this sort of tech and being amongst the first to get it because we are Silicon Valley and living in the future!

And I made myself very unpopular by sticking up my hand and saying in my very English accent "You mean you guys don't have that stuff here yet?"

And I made myself very unpopular by sticking up my hand and saying in my very English accent "You mean you guys don't have that stuff here yet?"

9 years ago #9598155

6

0

I'm not particularly psyched for someone being able to run through payments without pin confirmation if my card got stolen. That, and as other people have said, in this age of snooping, the more entities I can avoid giving data to, the better.

9 years ago #9597742

5

0

It's pretty uncommon in the US. We've only just gotten chip cards...but no pin, so it's not actually any safer...

9 years ago #9683067

4

0

As argued in the show Adam Ruins Everything, new technology is not the end of the world, it's just a new way of doing what we've been doing for millenia. Also, Americans read more books than ever, so that's not going anywhere. All the hipsters and old people are doing is complaining about newer generations, which people have been doing for thousands of years. Literally, Sokrates claimed the written word would destroy modern learning, and another philosopher wrote about how the youth nowadays has become rash and disrespectful

9 years ago #9599236

4

0

What's a contactless credit card? What even is a credit card? I saw people with them in the hotel and sometimes in Ecuador and Australia, but apart from that then what is the purpose they do?................

You guys know I have little to no contact with the world, I see you on the SatW forums...

You guys know I have little to no contact with the world, I see you on the SatW forums...

9 years ago #9598446

4

0

Aren't those touch pay cards really easy to clone and doesn't the lack of a PIN mean there's no security if it's stolen?

I think I'll keep the security my PIN offers and deal with the apparently massive inconvenience of inserting card

I think I'll keep the security my PIN offers and deal with the apparently massive inconvenience of inserting card

9 years ago #9598380

3

0

When my grandmother used the instant pay thing I emidiatly went:" but what if someone steals your credit card? Then they will be able to pay without the code." And she just went:" I don't think anybody would steal an old lady's credit card sweetheart."

I'm with England on this one. Technology is scary!

I'm with England on this one. Technology is scary!

Add comment: Please Sign in or create an accout to comment.

Support the comic on

Support the comic on

30